iowa disabled veteran homestead tax credit

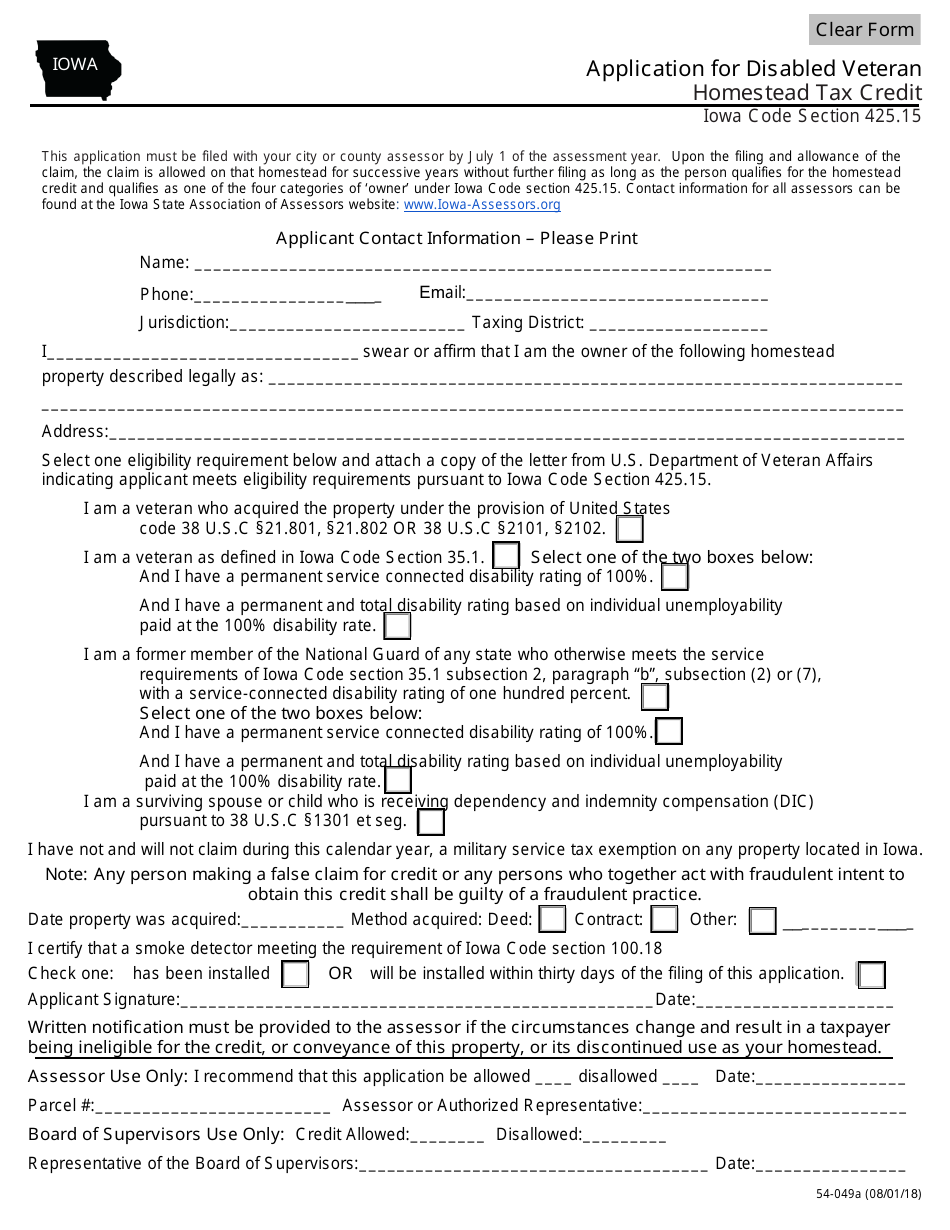

Monday - Friday. The bill modifies eligibility criteria to include disabled veterans with permanent and total disability ratings based on individual unemployability paid at the 100 disability rate.

States With Property Tax Exemptions For Veterans R Veterans

We have now placed Twitpic in an archived state.

. Iowa Assessor Hub provided by Vanguard Appraisals Inc Top. 800 am - 430 pm. Owners of Commercial and Industrial properties can also sign up for a Business.

Each year the County Auditor determines for that district a levy that will yield enough money to pay for schools police and fire protection road maintenance and other services budgeted for in that area. 121721 Were here for you. The deadline is July 1 of the assessment year in which the exemption is first claimed.

Dallas Cowboys Color Codes HEX. Free tuition for children of SC veterans who died in service or got permanent disability. PO Box 152 201 W Court Ave Winterset Iowa 50273.

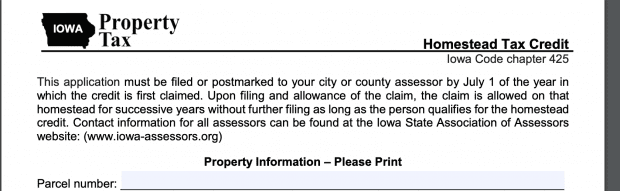

Homestead Credit Disabled Veteran Homestead Credit and Military Exemption Sign-Up Deadline. Business Property Tax Credit. Homestead Tax Credit.

2021 Homestead Credit Refund for Homeowners and Renters Property Tax Refund Forms and Instructions Form M1PR Homestead Credit Refund for Homeowners and Renters Property Tax Refund Schedule M1PR-AI Additions to Income Rev. Tax Levies and Assessed Values There are a number of different taxing districts in a jurisdiction each with a different levy. Disabled Veteran Homestead Tax Credit Forest Fruit Tree Reserve Non-Profit Tax Exempt.

Like the homestead exemption only school districts are required to offer this exemption. SB282 - Providing income tax credits for aerospace and aviation program graduates and their employers and a credit for school and classroom supplies purchased by teachers enacting the Kansas affordable housing tax credit act and the Kansas housing investor tax credit act providing homestead property tax refunds to certain persons based on the. The primary duty and responsibility is to cause to be assessed all real property within herhis jurisdiction except that which is otherwise provided by law.

Qualifying homeowners can get up to a 7000 reduction based on the assessed value of their home and primary residence. Under Alabamas homestead exemption residents including veterans who have a permanent and total disability are exempt from property taxes regardless of their income or the assessed values of their homesThe Alabama Department of Revenue defines a. DISABLED VETERANS HOMESTEAD TAX CREDIT Application must be filed with the Assessors office on or before July 1.

Find Your Property Data Owner. The following property tax credits andor exemption have an annual deadline of July 1st. So if your home is worth 150000 and you receive the homestead exemption the school district tax rate will only apply to 125000 of you home value.

Disabled Veterans Homestead Tax Credit and Military Exemption is July 1 2022 for the 2022 assessment year taxes payable September 2023 March 2024. 651-296-3781 1-800-652-9094 wwwrevenuestatemnus Contents Page Do. This legislation from the year 2014 provides 100 exemption of property taxes for 100 disabled service-connected veterans and Dependency and Indemnity Compensation DIC recipients.

Persons who are at least 65 or who are disabled can claim an additional exemption of 10000. The 2021 assessed value will be the basis of your tax bill in 2022- 2023. Applications may be submitted to our office via in person email.

When recruiting we work with talent resources that focus on diversity and Veterans. The Dallas Cowboys colors HEX codes are 003594 for royal blue 041E42 for blue 869397 for silver 7F9695 for silver -green and FFFFFF for white. The assessor in Iowa is charged with several administrative and statutory duties.

This would include residential commercial industrial and agricultural classes of property. Additional credits for seniors 65 and older and the disabled. Sign up for the Homestead Tax Credit Military Exemption or Disabled Veteran Homestead Credit in the Assessors Office.

Le mars iowa 51031 voice. If you are not satisfied that the foregoing assessment is correct you may contact the assessor on or after April 2 to and including April 25 of the year of the. Iowa State Association of Assessors.

Permanently disabled veterans are eligible for exemption of property tax on their primary homes and deduction on homestead tax. Qualifying homeowners can get property tax credit up to 375 per year. A current benefits paid letter isssued within 12 mo of application date to protect your privacy do not send any personal health information 2.

Theres so much riding on the name as the chosen name can have a substantial impact on your brands overall success. Dear Twitpic Community - thank you for all the wonderful photos you have taken over the years. Disabled Veteran Homestead Tax Credit Family Farm Tax Credit Homestead Tax Credit.

Disabled Veterans Homestead Tax Credit. Julie Carson Assessor 500 15th Ave SW Cedar Rapids IA 52404. Keosauqua Iowa 52565 Voice.

Forms are available by clicking on the Forms icon on the left side of this screen or wwwcedarcountyiowagov. Feel free to contact the. The Blue Alert Foundation was Founded and Operated by an 100 Service-Connected Disabled Veteran that served in the United States Army Military.

On March 5 2015 Governor Branstad signed in to law House File 166 an Act relating to the disabled veteran homestead tax credit. Department of Iowa Revenue. Supporting documentation to accompany the DVHTC application.

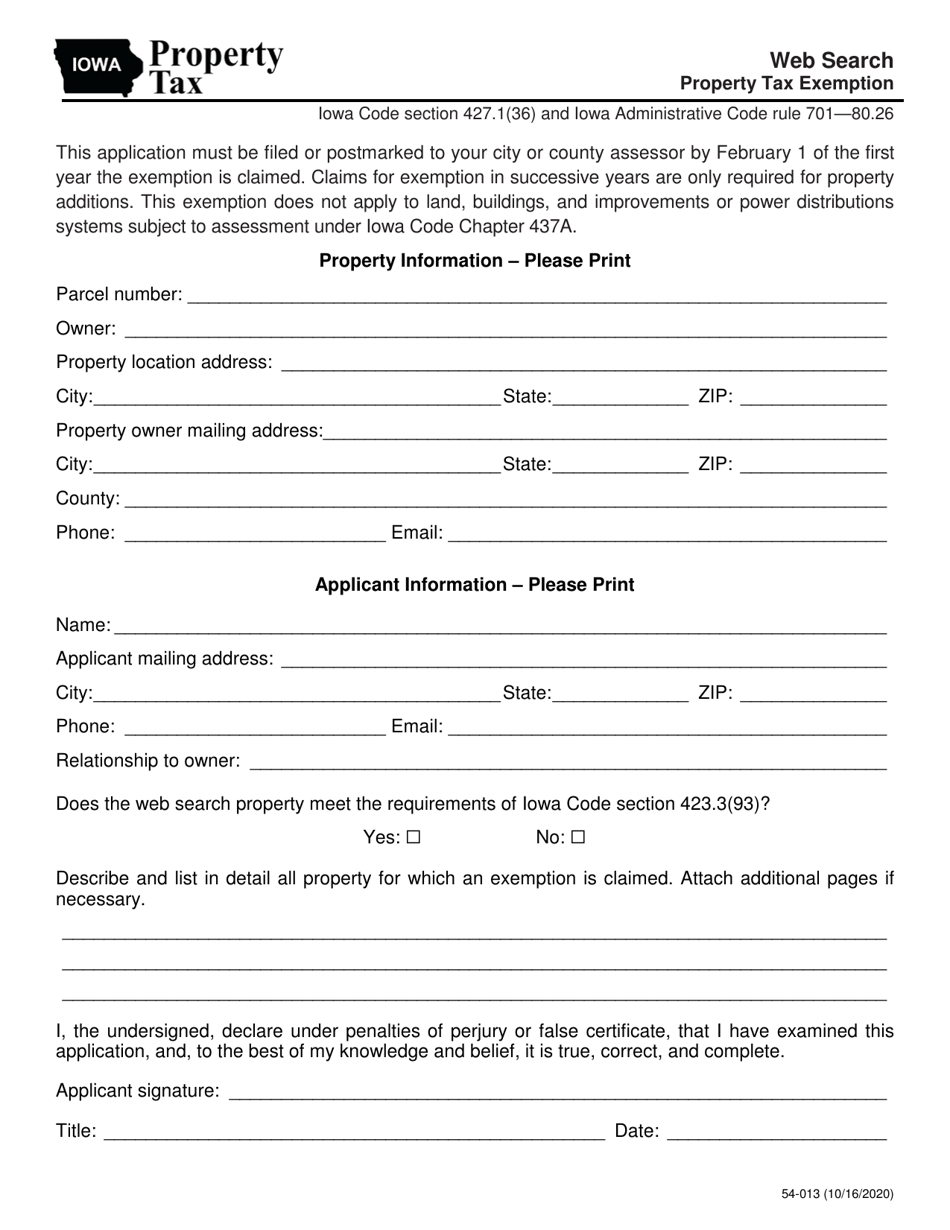

The disabled veteran homestead tax credit application must be done in the assessors office and cannot be done online. Property Tax Exemption Application. We also have applications in our office for the disabled veteran homestead tax credit.

Homestead Tax Credit Business Property Tax Credit Other Exemptions Credits. Disabled Veteran Homestead Tax Credit. Iowa Property Tax Apply.

When recruiting we work with talent resources that focus on diversity and Veterans. Just as naming your pet or baby can fill you with both excitement and angst naming your business baby can do the same. Property Tax Exemptions for Disabled Veterans by State Alabama Property Tax Exemptions.

Honorably discharged veterans are given preferences for public and state jobs.

If You Purchased A Home Last Year And It Is Your Primary Residence You May Be Entitled To A Homestead Real Estate Tax Exem New Homeowner Real Estate Estate Tax

18 States With Full Property Tax Exemption For 100 Disabled Veterans The Definitive Guide Va Claims Insider

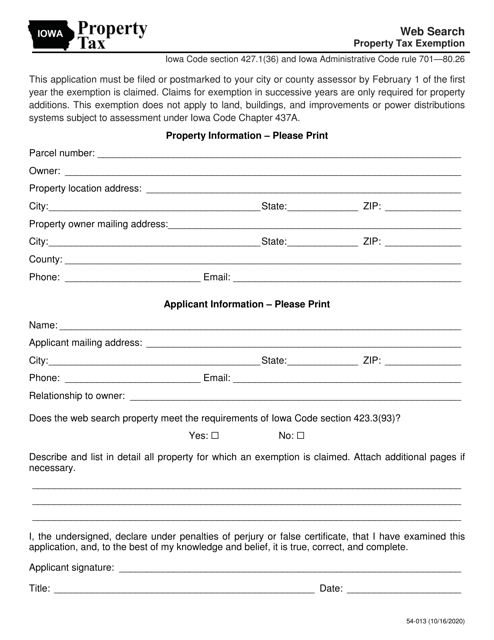

Form 54 013 Download Fillable Pdf Or Fill Online Web Search Property Tax Exemption Iowa Templateroller

Homestead Tax Credit More Mop Boley Real Estate

Form 54 049a Download Fillable Pdf Or Fill Online Application For Disabled Veteran Homestead Tax Credit Iowa Templateroller

Form 54 049a Download Fillable Pdf Or Fill Online Application For Disabled Veteran Homestead Tax Credit Iowa Templateroller

Homestead Tax Credit More Mop Boley Real Estate

Veteran Benefits For Iowa Veterans Guardian Va Claim Consulting

I Also Have Friends Who Dont Have To Pay Property Tax After Getting Medical Disability Does Fox News Want This To Go Away R Military

Form 54 049a Download Fillable Pdf Or Fill Online Application For Disabled Veteran Homestead Tax Credit Iowa Templateroller

Top 10 Best States For Disabled Veterans To Live 100 Hill Ponton P A

Form 54 013 Download Fillable Pdf Or Fill Online Web Search Property Tax Exemption Iowa Templateroller

18 Best States For Veterans To Buy A House The Insider S Guide Va Claims Insider